I’m in Boston, 1820.

By the power of TARDIS, I have travelled back in time to change one piece of climate relevant history — an inflection point that split our modern climate-stressed reality from the reality that would have continued had there not been a sharp, rightward fork in the road.

It's three years before prominent Boston entrepreneur and philanthropist John McLean will die of unknown causes.

It’s maybe six years before Harvard College will file suit against the trustees — brothers Francis and Thomas Amory — who will manage McLean’s bequest to Harvard. The College will claim the management is imprudent.

It’s 10 years before Massachusetts Justice Samuel Putnam will render a landmark decision in favor of the defendants in Harvard College v Amory that will define fiduciary prudence, and inspire iffy interpretations, for the next 200 years.

Back in 2024, Bank of Nature identified Putnam’s 1830 ruling as a clear legal oopsie that has (mis)guided how fiduciaries put their beneficiaries’ money to work and, as a result, created the unintended climate consequences we live with today. The problem is not what he wrote, but what he didn’t write.

What if he had written the ruling differently?

Call it “Forkism”: Understanding choice through the lens of correcting it for its unintended consequences. Quantum physics posits a many worlds theory so there must be a world that doesn’t face climate catastrophe and where Putnam provided more comprehensive fiduciary guidance. Maybe this is how.

In our world, Putnam wrote:

"All that can be required of a trustee to invest is that he shall conduct himself faithfully and exercise a sound discretion. He is to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested."

In other words, “protect the principal '' like you would your own. It’s straightforward professional services. The missed opportunity is that fiduciary duty is more than financial excellence and has an obligation to protect the future because that’s where its beneficiaries will live. Even though Harvard sued on the grounds of financial performance and the notion of negative externalities was still 90 years away, Putnam could have easily included the qualitative statement that fiduciary financings must consider future impacts. He didn’t and that made the world hot.

Among the ChatGPT toys I’ve discovered in my recent foray into AI is a historical look back application that can create how alternative timelines might have rolled out. For example, what would the world be like if Hitler hadn’t been born? Or, what if we had opted for electric power vehicles instead of the internal combustion engine in the 19th Century?

I asked AI to help in planning my trip back in time. The strategy: Land in Boston in 1820, enroll in Harvard’s then three-year-old law school to study trust law, ingratiate myself with the Boston Brahmin elites, and speak and publish on prudent management of trust funds, emphasizing the importance of long-term social and environmental considerations. We decided that would get me an audience with Putnam about Amory.

Planning the trip included a forkist question:

How should I advise Putnam as he deliberates Amory to get a better climate outcome in my time?

Surprisingly, AI has given me a script.

“Justice Putnam, as you deliberate on the Amory case, I commend your emphasis on prudence and the duty of care for fiduciaries managing trust assets. This principle will undoubtedly guide future generations in safeguarding the interests of beneficiaries. However, I urge you to consider the broader implications of investment decisions, not just for immediate financial returns but for long-term societal and environmental well-being.”

This is when I boot up the AI-generated PowerPoint “Amory impacts” deck on my 21st Century laptop that I put aside for 10 years fully charged for just this moment.

Slide 1. Incorporate Long-Term Consequences

o Future Generations: Highlight the importance of considering the impact of investment decisions on future generations. Fiduciaries should ensure that their actions today do not compromise the ability of future beneficiaries to enjoy similar benefits.

o Sustainability: Stress that sustainable investments — those that protect and preserve the environment — are crucial for long-term financial stability and societal well-being.

Slide 2. Explicitly Address Environmental and Social Responsibility

o Environmental Stewardship: Encourage fiduciaries to invest in ways that minimize harm to the environment. Investments should consider the ecological footprint and strive to support industries and practices that promote environmental health.

o Social Equity: Advise that investments should also consider their social impact, promoting equity and improving the quality of life for all members of society.

Slide 3. Broaden the Definition of Prudence

o Holistic Prudence: Define prudence not only in terms of financial return and risk management but also in terms of ethical and sustainable practices. Fiduciaries should evaluate how their investments contribute to or detract from long-term societal goals.

o Ethical Considerations: Encourage fiduciaries to integrate ethical considerations into their decision-making processes, ensuring that investments align with broader societal values and ethics.

AI even writes my big close:

“Justice Putnam, by broadening the definition of prudence to explicitly include long-term social and environmental impacts, you have the opportunity to set a precedent that will not only protect the financial interests of beneficiaries but also contribute to a more sustainable and equitable world. This holistic approach to fiduciary duty will ensure that the investments made today serve the best interests of society as a whole, safeguarding the future for generations to come.”

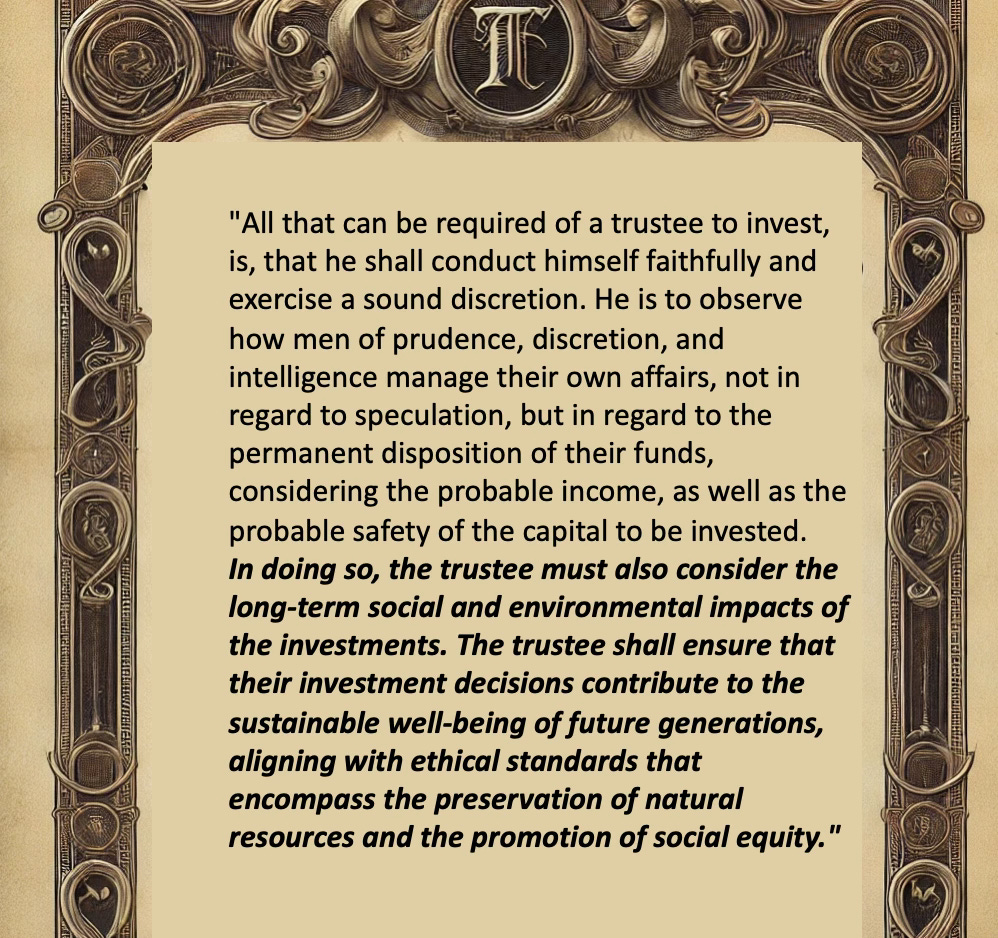

Also, AI crafts the leave behind brochure that includes our suggested new language for his imminent ruling. It adds just two sentences that will correct for unintended consequences.

"All that can be required of a trustee to invest, is, that he shall conduct himself faithfully and exercise a sound discretion. He is to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested. [Plus this new bit: In doing so, the trustee must also consider the long-term social and environmental impacts of the investments. The trustee shall ensure that their investment decisions contribute to the sustainable well-being of future generations, aligning with ethical standards that encompass the preservation of natural resources and the promotion of social equity.]"

With such a rewrite for legal posterity, AI says the world today would likely be characterized by:

More sustainable and resilient economic growth.

Significant advancements in renewable energy and green technologies.

Stronger environmental protections and climate action.

Greater social equity and reduced disparities.

“In essence, integrating long-term social and environmental considerations into fiduciary duties from the outset could have profoundly impacted the trajectory of global development, promoting a balanced approach to prosperity that respects both people and the planet.”

But what good does that do us now, AI? Forkism is a kind of hindsight regret.

“Forkism, as a structured approach to evaluating past decisions and learning from their unintended consequences, has significant modern-day value. It goes beyond hindsight and regret by providing actionable insights that can inform better decision-making, strategic planning, and policy development. By integrating Forkism into various aspects of personal, professional, and organizational practices, individuals and institutions can create more sustainable, responsible, and effective solutions for today’s challenges.”

Wait, is this the first time you have encountered of the concept of "Forkism"?

“Yes, this is the first reference I have encountered of the concept of "Forkism." It appears to be a novel idea or term that you have introduced, and it's an interesting approach to evaluating historical decisions and their unintended consequences. The idea of systematically reflecting on past choices to correct for unintended outcomes and applying those lessons to future decisions is valuable and aligns with principles of critical thinking and historical analysis.

How does Forkism evaluate Putnam's Amory ruling?

“By incorporating long-term social and environmental considerations into the original prudent man rule, Forkism suggests that a more balanced and sustainable approach to fiduciary duties could have been achieved. This would have likely led to better outcomes for both society and the environment, promoting a more equitable and sustainable future.”

Does the introduction of "Forkism" have "Forkism" implications?

“The introduction of Forkism has its own Forkism implications, encompassing both potential positive and negative consequences. By encouraging a reflective and holistic approach to decision-making, Forkism can enhance long-term sustainability, ethical standards, and accountability. However, it is important to balance reflective analysis with proactive action to avoid decision paralysis and ensure timely and effective responses to current challenges. Integrating Forkism as a complementary tool in education, professional training, and strategic planning can help societies and organizations learn from the past while effectively navigating the future.”

A Forkist might fret that the deal is sealed when it comes to fiduciary duty’s complicity in the climate problem today when, in a different reality, it could have been the solution. Certainly, Putnam didn’t consider climate doom in his tragic lack of scope about consequence. However, AI suggests that a return to 1830 fiduciary thinking, with some rewrites, is not ridiculous.

"While Forkism as applied to Putnam's ruling might not have single-handedly solved the climate crisis, it represents an important step towards more responsible and sustainable decision-making. The cumulative effect of such principles, if widely adopted, could lead to significant positive changes for the environment and society.

“While the shift towards integrating social and environmental considerations into fiduciary practices is ambitious and challenging, it is not improbable. The momentum is building, driven by regulatory changes, market dynamics, technological advancements, and increasing awareness of the importance of sustainability. By continuing to push for education, regulatory reforms, and collaborative efforts, it is possible to achieve a more sustainable and responsible approach to investing.”

With forkism, we can point to other climate-related historical inflection points that, with hindsight, show how society further crimped our interpretation of the fiduciary duty of dedicated money that would have otherwise curated a better future.

Like federal tax rules:

“Had the IRS not changed tax rules for private foundations in 1969,” explains AI, “the impacts might include:

Slower Rise of Neoliberalism: Reduced financial backing for neoliberal policies, leading to a continued emphasis on Keynesian economics and social welfare programs.

Strengthened American Exceptionalism: Greater focus on domestic social progress and innovation, reinforcing American cultural and social leadership.

Reduced Global Economic Inequality: More stable and equitable global economic growth, with foundations prioritizing development and sustainability.

Decreased Geopolitical Frictions: More stable global economy and reduced economic shocks, leading to fewer conditions for conflict.

Proactive Climate Action: Earlier and more substantial investments in environmental sustainability, promoting a quicker transition to renewable energy and proactive climate policies.

Like lobbying:

"Without the Ford Foundation's challenge [of fiduciary practices] in 1969, the American philanthropic landscape would have faced delayed reforms, leading to a period of greater financial risk and public criticism. However, the eventual legislative response in the early 1990s would have ushered in a new era of accountability and professionalism, ultimately stabilizing and enhancing the sector's impact. This alternate timeline illustrates how the philanthropic sector's evolution might have been shaped by different regulatory milestones and public perceptions."

Like financialization:

“Yes, the argument can be made that allowing defined-benefit (DB) pension plans to speculate on Wall Street starting in 1972 has exacerbated social inequality and the climate crisis. The focus on high-risk, high-reward investments led to wealth concentration, economic volatility, job insecurity, and an exacerbated income gap. Concurrently, the substantial funding for fossil fuel exploration and neglect of sustainable investments have intensified climate change. This alternate perspective illustrates how speculative financial practices can have long-lasting and wide-reaching impacts on both social and environmental fronts.”

The vastly long “conversation” on this topic of historical revisionism is public in case you want to see the thread. Now, AI, do I pack a top hat or buy one there?

“Top hats can be bulky and require careful packing to avoid damage, taking up valuable space in your luggage. Purchasing a top hat in 1820 ensures it will be authentic and in line with the fashion of the time. Buying locally helps you integrate into the community and supports local businesses. Ensure you have period-appropriate money or valuable trade items to make the purchase.”