Hero’s superpowers: Size, purpose, time

"Fiduciary Finance" as a transformational climate strategy we didn't know we needed

How did we get by without microwave ovens? How did we get by without cell phones or the Internet? What innovation came to be that we didn’t know we needed — until it arrived?

How did we get by without Fiduciary Finance?

We live in a world wracked by a climate threat so unwieldy, so large-scale, so planetary, that we are are paralyzed into doing what amounts to nothing. Sustainability and conservation, necessary but insufficient, lack the size, purpose and time required to take action at the scale of climate.

What does?

If anything in modern society is built to embody the kind of long-termism that climate remedies require, it’s fiduciary money like pensions and endowments that are managed by fiduciaries. At Bank of Nature, we call fiduciaries “the untapped heroes of the climate crisis” with the potential to pay for a climate fix right now - when they don’t yet.

These financial professionals have the vast monetary scale to do more. They have a mission — called fiduciary duty — that obligates more, especially against the backdrop of climate inaction.

“Even if the future is climate-changed, the duty of fiduciaries to pay benefits remains unchanged,” said financial philosopher Tim MacDonald, when we sat down to write this three-part interview on the drivers of Bank of Nature powered by fiduciaries.

Fiduciary money must create its own channel of investment that is designed to ensure it thrives. Tim calls it Fiduciary Finance, a new idea that unlocks a whole lot of potential for climate action. This is the second of the three-part series.

The Hero’s superpowers: Size, purpose, time

IE: Hi again, Tim. Finance is a big, scary and mysterious topic for most people navigating in this society. At Bank of Nature, we argue that’s intentional to keep the scrutineers away. In your finance philosophy, you break down the use of money in society in six ways. What are they?

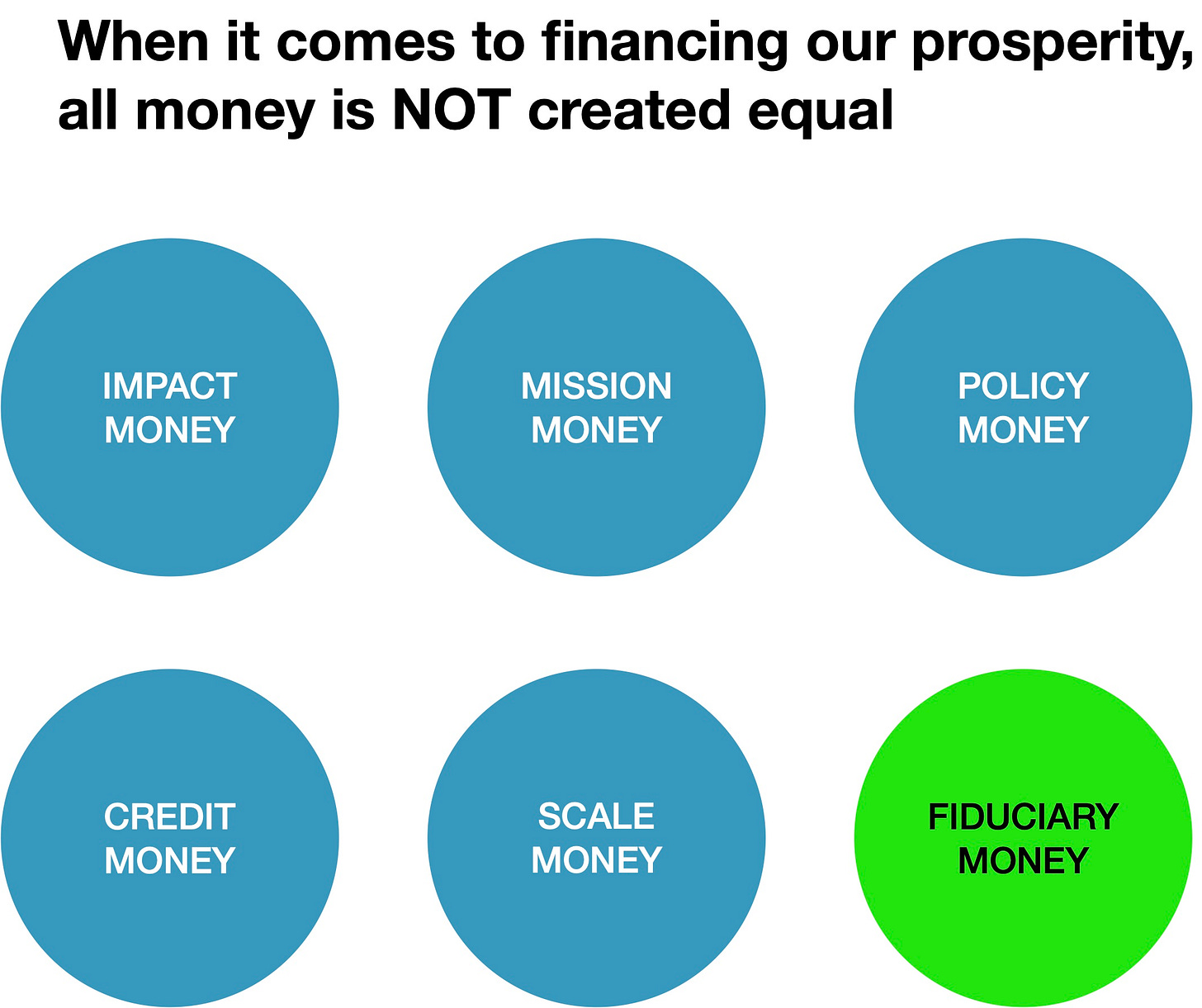

TM: Each kind of money is created by moving it through a different social structure. Each of these structures aggregates surpluses saved by individuals and deploys those aggregations as financing for enterprises that shape our economy, now and in the future. Each type of money has its own purpose, powers, moral code and accountability. Importantly, Bank of Nature is bringing to the forefront a sixth money category that has size, purpose and time to address the climate threat.

I describe them as:

Family & Friends (Rich People) aggregating family surpluses to care for the family and its friends, and deploying those aggregations through patronage of enterprise for IMPACT — which is whatever the family and its friends believe are good impacts for them. This is the old social structure of the aristocracy.

Church & Philanthropy (Do Gooders) aggregating surpluses saved by people to care for others and deploying those aggregations as grants to fulfill a MISSION.

Taxing & Spending (Government) aggregating surpluses set aside by taxpayers to contribute to public health, safety and welfare and deploying those aggregations as subsidies for POLICY.

Banking & Lending (Moneylenders) aggregating surpluses saved by individuals to manage their personal or organizational finances (safekeeping, payments and accounting) and deploying those aggregations as credit against PROPERTY.

Exchanges & Funds (Speculators, Market Makers, the Capital Markets and “Capitalism”) aggregating surpluses saved by individuals to put their money to work making more money and deploying those aggregations through securitization for speculation on SCALE/GROWTH/movement in market clearing price.

Pensions & Endowments (Institutional Fiduciary Owners of Intergenerational Fiduciary Money) aggregating surpluses saved to provide certain people with certainty against life’s future financial uncertainties and deploying those aggregations through negotiation for SUFFICIENCY/ENOUGH to keep their pension or endowment fully funded and ongoing into the future.

IE: It’s No. 6, “fiduciary money”, that is the exciting new prospect for what you call Fiduciary Finance. Your philosophy removes fiduciary money from speculation and gambling on Wall Street and gives it its own dedicated channel. To be clear, Fiduciary Finance is not yet an option for fiduciaries, but it’s not hard to see how it might be implemented. It’s what we offer through Bank of Nature.

Give us a definition of “Fiduciary Finance.”

TM: Pensions and endowments are, in bigger words, institutional fiduciary owners of intergenerational fiduciary money.

Through Fiduciary Finance, institutional fiduciary owners provide financing to enterprises and the economy directly, through negotiation that creates value and embodies “values” like climate security. We call that stewardship. Fiduciary Finance replaces the current practice of fiduciaries to invest derivatively, through speculation, in corporate finance markets like Wall Street.

IE: You talk about the power of pensions and endowments to negotiate. What does that mean?

TM: It begins with a formula: Size + Purpose + Time = the power to negotiate. That’s what fiduciary money can do but doesn’t. It’s what changes the game at planet-scale for crises like the climate threat.

Let’s look at the current structure of how we do business.

Right now, we have Wall Street doing deals with industry and pension and endowment fiduciaries doing deals with Wall Street. Wall Street is negotating what’s important to Wall Street. That’s growth and market-clearing prices. It is not climate security nor is it about creating a good future. Wall Street is not about prudent stewardship that supports future beneficiaries.

Fiduciary Finance is about creating a good future, because it promises it for beneficiaries now and in the future. Pensions and endowments don’t need to hire the Wall Street middle person. As institutional intergenerational fiduciaries, they are very large, they are very purposeful and the have unlimited amounts of time. Capacity equals power. They can negotiate for themselves and cut their own deals.

IE: So, we’ve established that fiduciary money can cut its own deals, without the Wall Street circus, by negotiating directly with business. What are they negotiating for?

TM: Two things: fiduciary minimums and social-environmental values. That’s stewardship and it can be applied directly to a crisis like climate. Fiduciary Finance replaces speculation with stewardship, which is my main argument.

IE: Let’s fast forward. You’re succesful in getting Fiduciary Finance into mainstream practice. How does it work?

TM: There is an existing, successful financial template that Bank of Nature is going to follow. It’s in real estate. Institutional financing for real estate is done by agreeing on formulas for sharing in future, or long-future, cash flows from the real estate project. Those formulas include agreements on the values that are “valued” in running the business… like LEED certifications, fair contracting, community engagement, for examples.

What happens already today, in real estate, becomes the template for what happens in financing enterprise more generally. Enterprising visionaries who need money to fund their visions connect with fiduciaries, either individually or in clubs. They sit down and hammer out agreements on the business proposition and how commerce will be conducted. This happens mostly in the cash flow modeling, and especially in the line item allowances for revenues and expenses. Importantly, in addressing our big scale issues like climate, these direct deals will have critical environmental and social priorities baked into the cash flows, such as:

Fair trade throughout all supply chains

Accountability to society through compliance with the spirit and the letter of applicable laws, business ethics and community engagement

Paying nature to “Make More Nature”- a primary theme of Bank of Nature to offset negative externalities and our debt to nature

Fair pay, benefits and conditions for workers

Fair dealing with customers and competitors in all distribution channels

IE: How does it pay off in a better future?

TM: Well, we will get tens of trillions of fiduciary money flowing into enterprises that put priorities on social and environmental justice as the positive byproducts of how they do business. At Bank of Nature, we want to pay nature a dividend. This is how. We want to open a third way that bypasses traditional government and industry to address large-scale crises. This is that third way at the requisite scale. This puts the future in today’s decision making.

For readers, you can connect with Bank of Nature here. We welcome comments, challenges, questions and improvements. Bank of Nature is a design initiative that explores the potential for a proxy for nature as a way to remake our economy and future to enhance our future threatened by climate inaction. Fiduciary money is an existing, ample way to pay for climate action.