Yesterday, I had the opportunity to speak to a New School class of fellows on the subject of “impact” entrepreneurship. Participants were chosen for their enterprising plans for a business that creates a social good and monetary gains — like regenerative farming.

Like all startup business plans, and assuming they aren’t self-financing, the challenge lies in finding the right kind of investor. This quest strikes at the heart of the Bank of Nature project, not just because we ourselves are seeking aligned investors, but because our initiatives are designed to identify and activate a new source of stewardship capital. This funding will be particularly appealing to entrepreneurs who don’t fit the mold of traditional venture capital models. Through our efforts, we aim to unlock capital streams that focus on long-term, sustainable, future-affirming impact—providing opportunities for businesses that prioritize social and environmental returns alongside financial ones.

Any business needs to make financial gains to cover the cost of operations and create the margins from which it can expand those operations. An entrepreneur has her own expenses to cover — housing, kids in college, pets at the vet, food on the table — that must be generated from the business. The issue is not about making a profit but how, why and for whom that profit is generated.

The shift from traditional business to social impact business is characterized as moving from wealth-creation to health-creation, challenging the sacred cows of extractive economics that prioritize short-term gains over long-term sustainability. This shift asks a crucial question: Why do we need to have a great business plan before we can have a climate plan?

The underlying answer is that we don’t need to have a traditional business plan first, but rather, we need to reframe what business success looks like to prioritize both economic and environmental health in tandem.

In traditional venture capital (VC) circles, investor support pivots on speculation and risk-taking. Investors who bear the high risk of early-stage startups expect windfall rewards if the enterprise succeeds. They aim for rapid growth and an exit strategy within 5 to 10 years, hoping for a return in the range of 20% to 30% annually, or as high as 10x on seed investments. Their objective is to maximize returns in the short term, often driven by a market-driven approach that values profitability above all else.

In contrast, the model proposed for fiduciary capital (FC) is rooted in stewardship, where the focus shifts from short-term speculation to long-term viability and impact. FC investors seek a sufficient cash flow return, typically aiming for 8% per year, but over a much longer horizon, often 30 to 50 years. This steady return meets actuarial minimums required by pension funds while placing qualifying stewardship provisos on investments. These provisos include safeguards that ensure business operations limit the damage they might otherwise cause to future generations, such as environmental degradation or social inequities.

For many impact-driven businesses, this longer-term, stewardship-focused threshold is more appropriate. However, these businesses often struggle to gain traction in traditional boardrooms where VC-style capital rules the conversation. Many good ideas for social and environmental impact businesses remain stuck on a whiteboard, their proformas failing to satisfy the growth and exit expectations of speculative investors. The challenge is that the proformas of impact businesses, which may prioritize sustainability, fairness, and environmental responsibility over immediate profitability, are simply not designed to appeal to the rapid-growth mindset of VCs. Instead, these businesses are better aligned with fiduciary capital models, which emphasize long-term sustainability and impact over short-term gains.

This shift from VC-driven wealth extraction to FC-led stewardship is critical in an era where the climate crisis demands a realignment of our economic priorities. We need a climate plan that transcends the business-as-usual models that prioritize growth and profits at any cost, and instead fosters an economy focused on restoration, regeneration, and sustainability. Only then can we reconcile business goals with the need for long-term environmental health and social equity.

This reframing presents an alternative pathway for businesses whose missions focus on impact, but who need patient capital — capital that is willing to grow slowly while ensuring the health of future generations and the planet.

Applied change builds incrementally on existing frameworks—it's like a dance on top of prior thinking, layering improvements over what is already accepted. In contrast, basic change requires a complete break from the status quo, rejecting existing assumptions and returning to foundational principles. It’s akin to the old saying: treat the disease, not just the symptoms—except this time, the issue involves planet-scale financial systems. The key question is: Is the root problem upstream or downstream from where we think it is? And what merit, if any, lies in the excuses used to preserve the status quo?

Consider this: money, law, and the economy are human constructs. Yet, we often hear that addressing the climate crisis is "too expensive" or "too complex." But money, law, and economy don’t exist in nature or grow on trees — they are inventions. The idea that there isn't enough of these constructs to solve a crisis they helped create is like inventing the rules of a game and then claiming you can't win by those very rules.

Moreover, geopolitics, another human construct, frequently obstructs a globally coordinated response to climate change, despite the scale of the crisis demanding such coordination. We continue to rely on governments and corporations to step up or hope that free-market innovations will somehow "tech" or "stock-pick" us out of the problem. But if we challenge these assumptions—if we strip away the reliance on traditional economic models and political structures—what new answers emerge?

Our fiduciary model fits quite nicely.

Part of the Bank of Nature process is asking tough questions that inevitably lead to even harder ones, pushing us to confront uncomfortable truths. While we might characterize human society as “broken,” we struggle to probe deeper into the “source code” that allows this to be acceptable. The status quo seems to shrug it off with an indifferent “oh, well…” attitude.

Following the trail of questions and answers is one of the first steps in design-thinking when unpacking complex challenges like the climate impasse. For instance, I had never considered the intersection of pensions and fiduciary duty until

introduced the concept to me. It led me to follow the breadcrumbs through the issues surrounding fiduciary money in the global economy — a problem that too few recognize as a problem. It struck me that this was the missing mechanism for the Bank of Nature to transition from a good idea into a viable impact business. Bank of Nature addresses:Scale: The critical missing link in addressing the climate crisis is financial scale. To make meaningful progress, we need to shift from extractive neoliberal economics to interactive fiduciary economics that prioritize long-term well-being over short-term profits.

Outcomes: Traditional notions of sustainability fall short because they don’t envision a time when the task is truly "done." As Donella Meadows envisioned, we must aim for "a world made sustainable," where the ongoing health of the planet is ensured beyond just managing crises.

Safety: Borrowing from Product Liability Law, we should ask what safer alternatives exist, especially when tackling large-scale systemic challenges. The law is filled with unrealized levers that can be pulled to create safer futures.

Time/Dignity: Retirement is often framed around the idea of golden years, but for certain pension participants, the system provides specific protections designed to ensure a dignified future. This fiduciary responsibility can be a powerful tool in reshaping how we think about long-term sustainability.

Each of these concepts fundamentally challenges the status quo at a scale proportionate to the climate crisis, and our goal is to demonstrate the potential for this kind of "impact" through legal strategies, legislation, labor relations, and effective public communication—like this Substack.

Once you start delving into fiduciary waters—asking fundamental questions like "What’s a pension?" and "What’s a fiduciary?"—it becomes clear that these concepts offer substantive solutions we haven’t yet fully explored. This is the challenge of the early phase: getting people to stretch into unfamiliar territory to confront a problem they may not recognize as a problem at all—or worse, seeing it as just another crisis, a fiduciary crisis, competing for their limited attention.

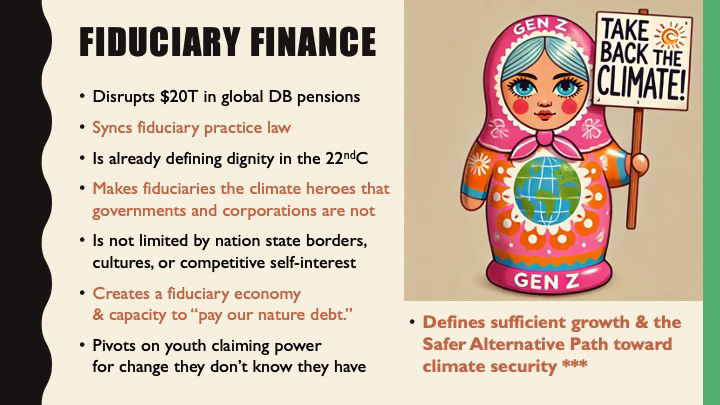

For Gen Z eco-beneficiaries in government jobs, retirement may seem irrelevant when, in fact, the opposite is true. They stand to benefit significantly from rethinking how pensions and fiduciary duties could reshape our approach to sustainability and climate action.

Breaking it down:

Pensions have a lower threshold for ROI compared to traditional venture capital, which makes them better suited for long-term, sustainable investments.

They have the scale and leverage to negotiate better terms, giving them the potential to set industry standards and shift capital toward more impactful ventures.

Pensions can operate anywhere, transcending borders and industries, allowing for global collaboration and sustainability-driven investments.

Pensions aren’t designed to compete with each other. Instead, they should, and increasingly will, collaborate to amass even greater scale and collective impact.

Fiduciary capital represents big money that isn’t inherently complicated or conflicted— it's simply being misallocated. The problem is not a lack of resources but a failure to align fiduciary responsibility with long-term environmental and social stability.

Bank of Nature’s various legal and legislative initiatives aim to fundamentally change how, why, and for whom vast sums of defined benefit (DB) plan money flow within the global economy. Aggregated, DB plans represent approximately $20 trillion, which accounts for about 20% of global GDP. This means that a significant portion of the world’s capital must adhere to fiduciary duties of care, loyalty, and impartiality for the benefit of all participants — including, for example, the 25-year-old school teacher starting their career today.

We argue that this $20 trillion should be directed in ways that ensure a dignified future for the youngest pension beneficiaries. But currently, it is not. This represents an unparalleled opportunity to shift the economy toward a fiduciary economy—one that prioritizes long-term well-being over short-term profits.

This transformation would do more than just safeguard pensions. It would also:

Redefine growth, prioritizing sustainability and shared prosperity over relentless profit.

Right-size Wall Street, aligning capital markets with broader social goals.

Defang private equity, reducing its outsized influence on industries and communities.

Minimize dark money politics, ensuring more transparent and accountable governance.

Lay stronger foundations for social and environmental justice, improving outcomes for health, education, and income equality.

Promote food security, democracy, and the common good.

At its core, this shift would also create a tailor-made funding source for impact-driven entrepreneurs, unlocking capital for businesses seeking investors who value long-term social and environmental returns alongside financial ones — at planet-scale.