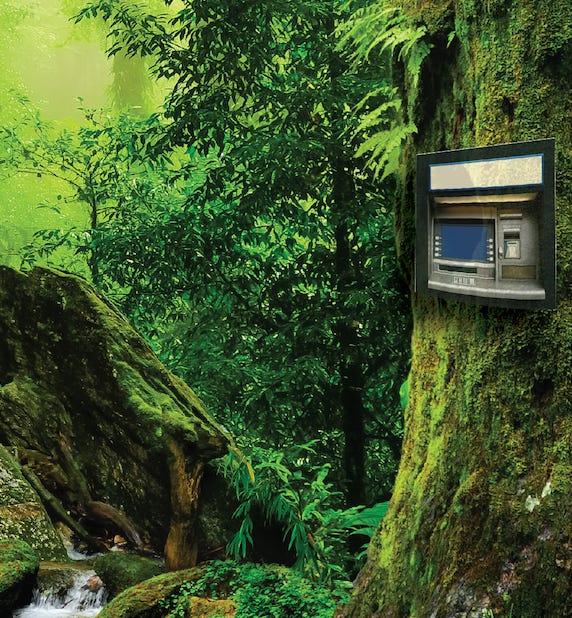

As origin stories go, Bank of Nature started with a question:

Is nature a bank?

If we consider how human society pulls value from nature, and its limited capacity, without a plan to return like-value, we treat the environment like a Las Vegas buffet that is divinely granted or, otherwise, a birthright. That's win-lose neoliberalism. If nature is a bank, that profoundly changes an extractive economy into an interactive economy that repays a debt to nature for our success story. A win-win is a fiduciary economy. Bank of Nature would be a driving mechanism of that economy.

The status quo is the former, not the latter. Yet, we’re borrowing from nature without terms and conditions on repaying the loan — a deal that wouldn’t fly at your corner bank. For a borrower in default, a bank will impose various fees, penalties and repossession. As such, I’ve likened nature to a cranky bank manager, us as deadbeat borrowers, and the climate crisis is an eviction notice.

Converting a metaphor into an actual bank has introduced us to the unique, viable and tailor-made fiduciary model that has, independently from government or enterprise, developed the financial wherewithal to work at the scale of climate. It doesn't yet and that's the opportunity.

I'm aware that most of our exploration over the past years has been about the power of fiduciary money to pay for climate security, when there are no other options. If we are to tackle the scourge of nature-minimizing negative externalities, address planet-scale injustices and overcome the tragic limitations of nation states to answer the challenge, we need something like fiduciary money that is ready to go, right now. If we are to unlock the potential of fiduciary money to be something like nature's banker, we need to untangle the misappropriation of fiduciary obligation, remove the chock hold of securitization, challenge the assumptions of the status quo and demand a full expression of the built-in, trillion-dollar benefits of fiduciary design.

This generation didn't create this direness, nor the generation before. The generation before that couldn't have fathomed the unforeseen environmental and social consequences of 20th Century globalism. We inherited the situation that is ours to fix. Bank of Nature's fiduciary economy is pointed at the available tools and resources to directly address the realities of a society that requires money as much as it requires oxygen, food, water and shelter. It's a Maslow oversight that money is not the transition from basic needs to level 2 — safety and security — which is still out of reach for half of the world's Earthlings. Finance, the black box of mystery for most humans, is the alchemy that turns a blameless $1 into $2. It's not magic, but it is intentionally complicated to discourage anything like a Bank of Nature investigation.

It's a difficult narrative. Recently, I had an opportunity to summarize it for someone new to the project. Maybe it answers questions that are unasked.

What is Bank of Nature?

We've identified a problem no one sees as a problem and it's at the heart of the climate crisis: Vast retirement savings that are designed to "curate a dignified future" between now and 2100 but, instead, are working actively and illegally to diminish that future. We can prove it. We have law on our side. Supporting legislative and litigation are begun.

We've innovated "Fiduciary Finance" that uses global pension funds, worth $30 trillion globally, to finance climate security — as they are designed to do. That means Bank of Nature, or another stewardship manager, will disrupt and unravel the BlackRock-Vanguard-Fidelity asset manager world by doing stewardship deals that meet “fiduciary-grade” financial and quality-of-future-living criteria. The numbers are eye-popping.

Our new idea pivots on the very old idea of fiduciary duty centered in the Duties of Loyalty, Care and Impartiality -- qualities that most of us see lacking in the status quo. Fiduciary duty is an amazing model for 21st Century citizenship.

We have identified fiduciaries as a new, legally vulnerable and far smaller target for climate activism — that sidesteps intransigent, traditional government and business “bad guys.” There are a few thousand global fiduciaries controlling the trillions required to bankroll “net zero” and “just energy transitions”. They aren’t stepping up as the climate hero… yet. That’s the opportunity.

Fiduciaries are “extranational”. When the climate impasse is defined by a lack of cooperation among 200 nation states, fiduciaries of pensions have no borders or cultures to limit their choices. They work anywhere on anything that meets a list of quantitative and qualitative (which is Bank of Nature's “radical” change) criteria.

A fully operational Bank of Nature will fund independent Climate Science and Climate Justice departments to give hard- and social-science the freedom from traditional government and industry to put big ideas to work. I have no idea what those ideas are but the experts will sort it out. It’s as close as we can get to “money no object” for global crises.

We are not more ESG or divestment or another green bank, natural asset company, government handout, or any other traditional climate approach lacking in the required scale. We are complementary. Fiduciary finance is a legal argument, not a social/political/moral/discretionary argument.

Success for our program shifts trillions toward our climate future. Importantly, the fiduciary obligation is limited to current and future retirees — like the 25 million US civil servants whose "pension promise" is backed by $5T+ of non-tax money at work right now in the global economy. So, one big idea here is that ensuring fiduciary obligations are legally met for a few retirees moves enough money to secure climate for the rest of us 8B. "Save the retiree. Save the world."

All of this turns a dry topic like fiduciary duty into the most exciting new innovation in climate finance. There is a very clear 55-year history of policy missteps in US fiduciary duty practice that opened a global Pandora's box of anti-climate finance that gets us to today. The missteps are correctable.

Our red-alert fossil fuel culture exists only because pensions were set free to gamble on Wall Street in 1972 — and were, thereafter, called "institutional investors". Ongoing environmental and social strife happens because the status quo is blinded by securitization, "market solutions" that require a business plan before a climate plan, extractive economics and the windfalls of Wall Street. Pension funds have quite literally amplified the worst of politics and industry and how they punt the climate crisis because their fiduciaries have lost sight of their purpose. They aren't banks or paragons of "financial excellence". They don’t need an exit strategy. The need not chase share prices. They are "immortal" and are already promised to people who will live in a climate-changed 2100 made less habitable by fiduciary choices today. Pensions need cash flow — and, there are safer alternatives to fulfill their legal obligations.

Bank of Nature offers a Safer Alternative Path. When the climate crisis lacks a coordinated scaled response, fiduciary money works at the scale of climate and with greater freedom than either government or markets. There is a role for the government, but not as the climate hero. The unexpected hero is the pension fiduciary — as weird as that might sound.