We filed fiduciary standards bill S.1644 in MA

The goal: To better instruct fiduciaries in charge of $90B in public pension money

Here in Massachusetts, Bank of Nature has taken its first concrete action toward rethinking how public pensions (specifically these types of defined benefits plans) provide a model for climate-finance. They have the mission, duty and enormous financial scale to do more and do it better as stewards of the economy.

We've introduced bill S.1644 in the State Senate to examine the governing law for public pensions. The law oversees $90 billion for 300,000 beneficiaries owed a "Pension Promise" in Massachusetts. The bill has been assigned to the Joint Committee on Public Service.

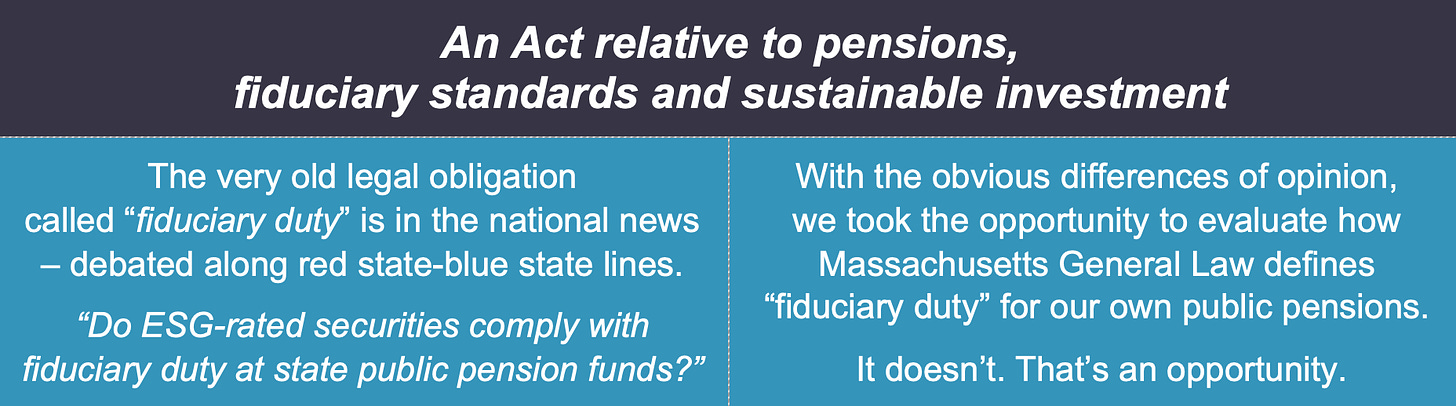

Our bill is timely with the current partisan debate in the US about whether ESG strategies comply with "fiduciary duty" at state pensions. You've likely seen the headlines -- most recently with the US Congress sending an anti-ESG bill to President Joe Biden to veto (as is expected as of this writing and just as he has opened Alaska to new drilling...).

When was the last time public pensions, fiduciary duty and ESG implications were debated in the Oval Office?

If our friends in divestment activism challenge public pensions from one direction, this fiduciary standards bill comes at the issue from the other side -- the language of the law. In MA, and likely everywhere there is an independent public pension system designed to reward civil servants, the law is vividly incomplete compared to how fiduciary practice happens. There are 6,000 public pensions in the US worth $5T.

For example, in MA, there is no "sole interest duty to growth at all costs" in law which is the main assertion from the ESG critics. For that matter, the fiduciary standards law doesn't actually have a definition for fiduciary duty, among other glaring omissions.

That leaves open the risk of fiduciary malpractice and the misapplication of billions and trillions that could be otherwise pointed at a climate remedy, among other chronically underfunded fiduciary-scale causes.

This is the opportunity: Because of the scale of money in play, we can address fiduciary causes like climate security for everyone if public pension fiduciaries just focus on delivering it to their own beneficiaries.

That includes the youngest new hires today who can't collect their retirement benefits until 2060 and could live to see 100 candles on the cake at the start of next century. That's not sci-fi, that's the window of obligation and impartiality that a public pension fiduciary must navigate in order to make good on the Pension Promise 75 years from now. Is there a better example of long termism in action?

This bill says it's not IF a fiduciary must make a financial return on $90B, but HOW that return is earned.

I've been getting this question: "Does this bill fix the climate crisis?" Not on its own, but the bill does specify that fiduciary choices must reckon with future consequences. Future legal challenges inspired by the new language or public pension self-regulation would need to happen next. For comparison, we can debate later whether ESG and divestment have fixed climate on their own.

I hope you can consider the bill's merits, comment, share and engage with us as it moves through the committee process. My goal is to make this a conversation for all public pensions to examine the mismatch between fiduciary law and fiduciary practice and how that impacts our ability to pay for a dignified future -- all without new taxes.

Feel free to reach out at ian@bankofnature.eco. More reading…