Why is Bank of Nature talking "fiduciary duty"?

And, what does fiduciary duty have to do with nature?

It’s all about the “How”.

Bank of Nature needs an engine. All this talk about fiduciary duty is about bringing the philosophy of Bank of Nature into reality as a real, live bank.

So, get comfortable with a word like “fiduciary”. Let “trillions” trip off the tongue. And start walking with us on the “Untaken Safer Alternative Path.”

The Bank of Nature initiative is two parts:

1) The what/The poetry:

Bank of Nature is a philosophy that says nature can be a bank — or should be a bank. The idea is maybe what drew you to this page.

At your bank, you borrow for a home mortgage, car loan or student loan. It’s a two-way relationship that gives you choices you might not have otherwise, because you needed money. The loan, as you know and accept, comes with terms like interest and penalties. Default on that loan and you face evictions, repossessions and bad credit scores.

It’s a metaphor that works if you, like us, see trouble in the status quo: Resource crises, limits to economic growth, social problems, extreme weather events, sea level rise, climate refugees, climate conflicts … you know the list.

The breakdown in climate boils down to this: We’ve borrowed resources from nature without knowing the terms and Mother Nature has come to collect. Here’s one of my dustier essays on the subject of nature as a cranky banker:

Yes, of course, nature is not a person. Nature cares not whether we thrive or expire. We’re talking to the fragile, ego-driven existential part of being a sentient animal in a degrading habitat from a basic disrespect for that habitat. In that way, nature is also not an all-you-can-eat buffet.

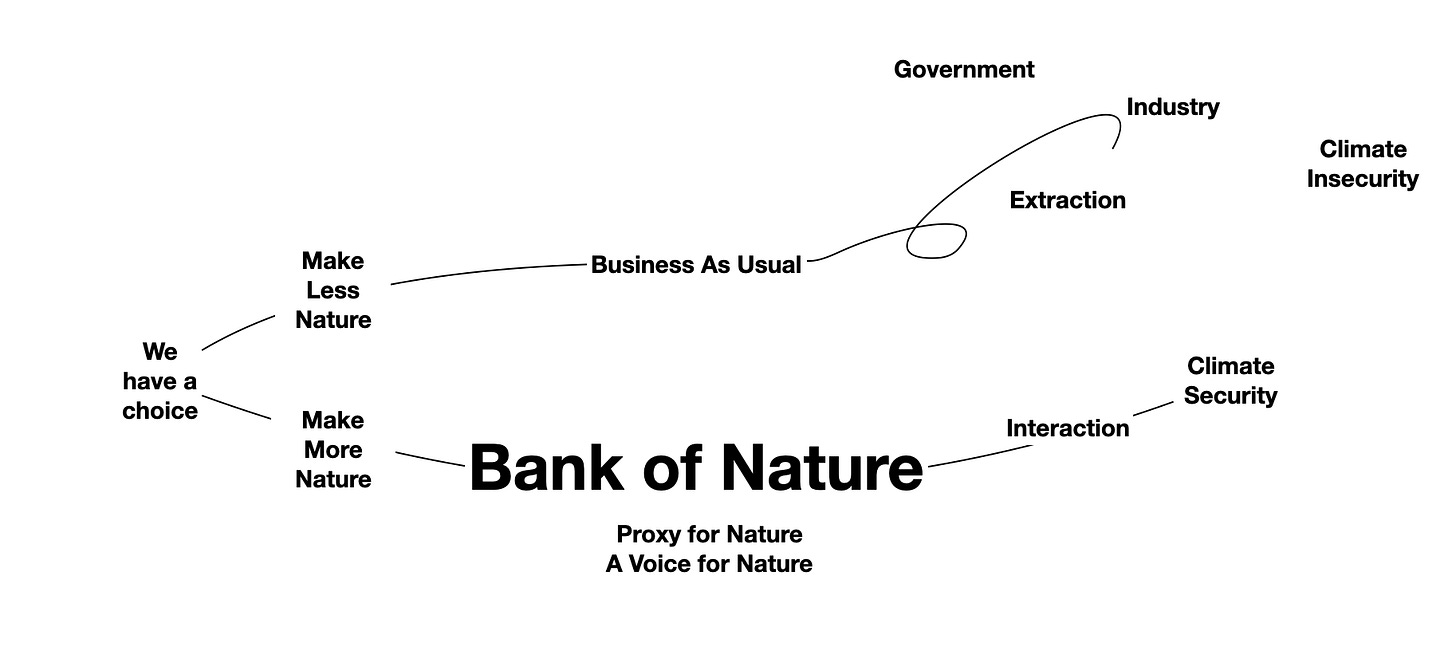

It’s a situation and point of entitlement that we have inherited, but is up to us to define and address. So far, society has chosen not to change Business As Usual because… well, lots of reasons, mostly based in the power of the status quo to protect itself against change and the fear used to stall change at scale. For instance, we haven’t yet clearly defined a viable alternative that isn’t the plot of a dystopian blockbuster movie.

That’s where we aim to come in. We don’t think the status quo is safe. What is safer?Bank of Nature is the embodiment of an “Untaken Safer Alternative Path” that offers a substantive shift in how we look at the future and how we get there.

We ask these kinds of questions:

“Do we owe nature a debt? Have we defaulted on that debt? How do we make good on that debt? How might nature collect on that debt?”

“Can the impacts of human accelerated climate change be explained as an eviction notice?”

“Shouldn’t nature get a return on investment for its resources we’ve taken to write our own human excellence story?”

“Why is it not a cost of doing business to reinvest in nature?”

“Might a proxy for nature, like a Bank of Nature, collect on our debt to nature and spend that money on regeneration and rehabilitation of the environment — and efforts to avoid eviction?”

The how/The power:

But first: Bank of Nature can only be a bank in reality if Bank of Nature has an ability to finance. Whatever Bank of America can do, we must do it better in the name of the Safer Alternative Path. That means money must flow in and out, with the financial rewards that come from being a lender. Regardless of your relationship to money and your thoughts about its role in the problems and solutions of today’s society, Bank of Nature is a reckoning about how we use money.

This is the part where we thank co-creator/finance innovator Tim MacDonald for his transformative theories about fiduciary finance — an innovation that, as one outcome, might just buy us longterm climate security. It’s very exciting, but you have to dip a toe.

I’ve spent more than two years now learning about this theory and how it makes Bank of Nature more than just a fanciful idea. It’s worth a look-see and, thus, we dedicate a lot of words to outlining fiduciary finance as the engine for Bank of Nature.

In the broad strokes:

Tim has identified the largest piggy bank in the world — with more money than nation states. That’s tens of trillions of dollars designed with the duty, mission and scale to lead on climate. Why doesn’t fiduciary money lead on climate? That’s the question that makes Bank of Nature doable.

Specifically, defined benefits pension plans, like those that reward public service workers, have enough money pinned to the futures of their own beneficiaries that the subtlest of changes makes a profound difference in the economy.

If we create a dignified future for pension beneficiaries everywhere — who contribute $26 trillion in aggregated savings in the global economy — are we not creating a dignified future for all of us? We want to point 12% of the global money supply at that one task — and none of those beneficiaries expect their future retirements to be spoiled by climate change issues made worse by their own pension fiduciaries.

It’s a breach of fiduciary duty — an ancient social contract in which a fiduciary, regardless of what the fiduciary wants or thinks, must take care of a beneficiary’s best interests. The language of the duty is the instruction. We argue that best practices that handle fiduciary money, like public pension plans, are in a breach of fiduciary duty.

If there is a trillion-dollar reckoning of fiduciary money that is noncompliant with fiduciary duty, as we argue, it will have to go somewhere where it is compliant…. like Bank of Nature.

This is money that is the scale of climate. That’s an important idea when we are asking government and industry to muster the money to address the climate crisis. Can they work at the scale of climate? Are they the right people for the job? How would you rate their work on the crisis so far?

Might fiduciaries in charge of vast fiduciary money guided by fiduciary duty pinned to the future wellbeing of their own beneficiaries be better heroes of climate security?

That’s what we are finding out. Please read more. And reach out if you have a way to expedite these ideas.

Nature Bank would make a good companion to the new asset class of Natural Asset Companies - coming to you soon via IEG & NYSE

https://www.intrinsicexchange.com

it's a fascinating idea! I'm trying to better understand the Bank of Nature approach and so please forgive what may be a stupid question.....

I think i understand the core philosophy - acting for, or even as, Nature, and seeking reparations for corporate externalities historically freeloaded onto ecosystems, funding recovery and restoration projects and building a more ecologically sustainable global business model.

But by shifting the interpretation of fiduciary duty to include these investments, as a necessity, or an obligation, won't there be an internal incompatibility created with the 'no net loss/preferably growth' requirements of the fund in terms of cash value? Many, perhaps most, repair and restore projects and programmes will be net costs on the fund because they are not designed to make an economic return, and in fact they will be operating quite rightly as a sort of debt repayment scheme to Nature. Will the balancing out of fiduciary actions within a fund end up putting pressure on these ecological interventions to generate profit, or at least reduce costs to net zero? This then starts to feel as if it is on the road to just designing new tradable asset classes under a Nature brand? I'm not sure that i've really understood the whole picture properly!

thanks,

Ian Boyd